An overview of the year that was, from our investment partners, Dimensional Fund Advisors.

Key takeaways

- Stock markets continued to climb higher in 2021, with the S&P 500 hitting a series of all-time closing highs and ending the year near a record.

- While COVID-19 continued to dominate headlines, concerns also focused on inflation and its potential impact.

- Investors saw volatility in areas like cryptocurrencies, highlighting the importance of long-term planning and flexibility in a fast-moving market.

It was a year of uncertainty and anticipation, of hopes for a return to a degree of normality following the onset of the COVID-19 pandemic in 2020. And it was a year that showed, again, the difficulty of making investment decisions based on predictions of where markets will go – as well as the enduring benefits of diversification and flexibility.

Coming out of a volatile 2020, investors sought signals as to which way the global economy was headed. The distribution of vaccines and the easing of lockdowns were followed by an economic rebound, but the emergence of new variants would be a setback for the recovery. Despite these challenges, global gross domestic product grew, completing the transition from recovery to expansion and eventually surpassing its pre-pandemic peak.

Rising inflation

Still, the recovery would be accompanied by labour shortages, supply chain issues, and rising inflation. Prices increased especially rapidly in areas such as food and energy, and the US consumer price index jumped 6.81% from year-earlier levels in November, a rise unseen in nearly four decades. The media was filled with debates about where inflation would go, what was causing it, how long it might last, and what could, or should, be done in response.

An investor pondering those questions might take comfort knowing that many assets in the past have outpaced even above-average inflation, as seen in Exhibit A.

Exhibit A: Stock performance vs US inflation, 1991-2021

How equities fared in 2021

Throughout the year, the market continued a relatively steady rise, with large cap stocks in the US ending 2021 near a record high. The S&P 500 Index generated returns of 28.71%. In addition to the effective vaccines, markets were buoyed by a number of other positive developments, including strong corporate earnings and increased consumer demand. In the third quarter, US corporations pulled in record profits – both in dollar terms and as a share of GDP (11%). That came as consumer spending generally trended higher throughout the year, rebounding from pandemic lows.

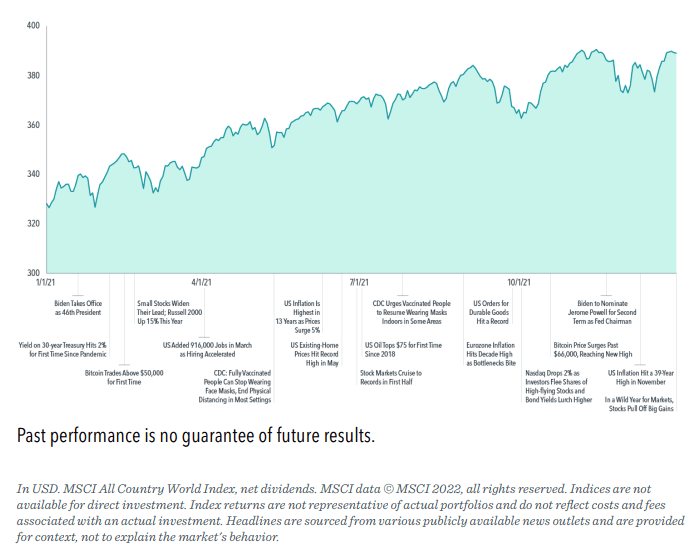

Likewise, global markets continued to rise alongside those in the US, despite some setbacks. Markets that started the year strong were up and down in the year’s second half but still near all-time highs. Global equities, as measured by the MSCI All Country World Index increased 18.54% (see Exhibit B). Developed international stocks, as represented by the MSCI World ex USA Index, rose 12.62%, notably stronger than emerging markets, which saw the MSCI Emerging Markets Index fall by –2.54%.

Exhibit B: The MSCI All Country World Index performance in 2021 was (largely) steady amid the storms

Fixed income assets and inflation

As with equities, when it comes to fixed income there is no reason to assume inflation will bring dire effects. From 1927 through 2020, median US inflation was 2.68%, and in the 47 years when inflation exceeded that rate, it averaged 5.49%. Many types of bonds beat inflation over those 47 years, which included double-digit inflation in the 1940s and 1970s. For investors particularly sensitive to the potential for rising prices, inflation hedging assets can help protect investors, as can strategies that focus on real (inflation-adjusted) returns. Bond investments should always be matched to an investor’s goals – they aren’t one-size-fits-all. But inflation concerns needn’t scare one away from fixed income.

The impact of government debt

Rising government debt levels may also lead some investors to worry about an adverse impact on stock returns. The US debt held by the public topped $22 trillion, up more than $5 trillion from the end of 2019 and 123% of GDP. In a more extreme example, China’s overall debt was 263% of its GDP late in 2021, driven by massive government-sponsored infrastructure and property investment, as evidenced by China’s beleaguered Evergrande Group, which defaulted on its debt in December.

However, the relation between country debt and stock markets is complex, in part because sovereign solvency is dependent upon many factors besides just debt levels. In addition, debt is generally a slow-moving variable whose expected value should be incorporated in market prices. Consistent with this belief, the evidence suggests there has not been a strong relation between country debt and equity market returns.

Remaining flexible in a fast-moving market

Spiking inflation and the ups and downs tied to the COVID-19 pandemic weren’t the only types of volatility drawing attention in 2021. Bitcoin and many other cryptocurrencies continued rising, prompting many investors to wonder whether this new form of electronic money deserves a place in their portfolios. But in its relatively short existence, bitcoin has proved prone to extraordinary swings, sometimes gaining or losing more than 40% in price in a month or two.

Any asset subject to such sharp volatility may be catnip for traders but of limited value as a reliable medium of exchange (to replace cash), as a risk-reducing or inflation-hedging asset (to replace bonds), or as a replacement for other assets in a diversified portfolio. Thus, while cryptocurrencies may hold some appeal for adventurous investors, it’s hard to make a case for a significant allocation of one’s overall assets to them in the current moment.

Concentrating your portfolio in a few hot stocks or cryptocurrencies – like focusing on any small number of holdings – can expose investors to substantial risk. Even if you manage to find a few winners, research argues that good luck is unlikely to repeat throughout a lifetime of investing. For every individual who got into and out of a hot stock or cryptocurrency at the right time, there’s likely another who bought or sold at the wrong time.

When breaking records sounds like a broken record

In a similar way, there may be a tendency to think markets reaching a new high is a signal stocks are overvalued or have approached a ceiling. Such concerns may be especially potent now, with the S&P 500 having notched 75 closing records in 2021 on a total-return basis. However, investors may be surprised to find that the average returns one, three, and five years after a new month-end market high are similar to the average returns over any one-, three-, or five-year period. For instance, in looking at monthly returns between 1926 and 2021 for the S&P 500 Index, 30% of the monthly observations were new highs.

After those highs, the average annualised compound returns ranged from over 14% one year later to more than 10% over the next five years. Those results were close to the average returns over any given period of the same length. Put another way, reaching a new high doesn’t mean the market will retreat. Stocks, at any time, are priced to deliver a positive expected return for investors, so reaching record highs regularly is the outcome one would expect.

This is a good reminder of the power of markets. Investors can’t predict the nature or timing of the next crisis, or the end of any existing ones. But markets are forward-looking and reflect optimism. New challenges will await, but rather than guessing at what will happen, investors can choose to trust markets and their long-term prospects. The year 2021 was one that emphasised the benefits of discipline and diversification, of planning and perseverance, in a market that was uncertain (like markets in all the years before it). As we enter 2022, looking backward can help as investors look to the future.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Issued by Dimensional Fund Advisors Ltd. (DFAL), 20 Triton Street, Regent’s Place, London, NW1 3BF. DFAL is authorised and regulated by the Financial Conduct Authority (FCA). Information and opinions presented in this material have been obtained or derived from sources believed by DFAL to be reliable, and DFAL has reasonable grounds to believe that all factual information herein is true as at the date of this document.

DFAL issues information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from DFAL will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.