While today’s uncertainty may seem unprecedented, investors have been there before – and markets have always bounced back over time.

Today, it certainly feels like the world is in a very uncertain place. Authoritarian states are flexing their muscles – with Russia violating Ukraine’s sovereignty and China’s ongoing subjugation of Hong Kong with the new National Security Law alongside its apparent support for Russia – being cases in point.

The West continues to struggle with what’s hopefully the back end of the Covid crisis as populations gather immunity through vaccination and infection, and new drugs and treatments come online.

Economically, the greatest challenge is soaring inflation hitting levels not seen for several decades. As a consequence, interest rates and yields on bonds have started to rise and global equity markets have started the year down.

All that can feel both gloomy and unsettling.

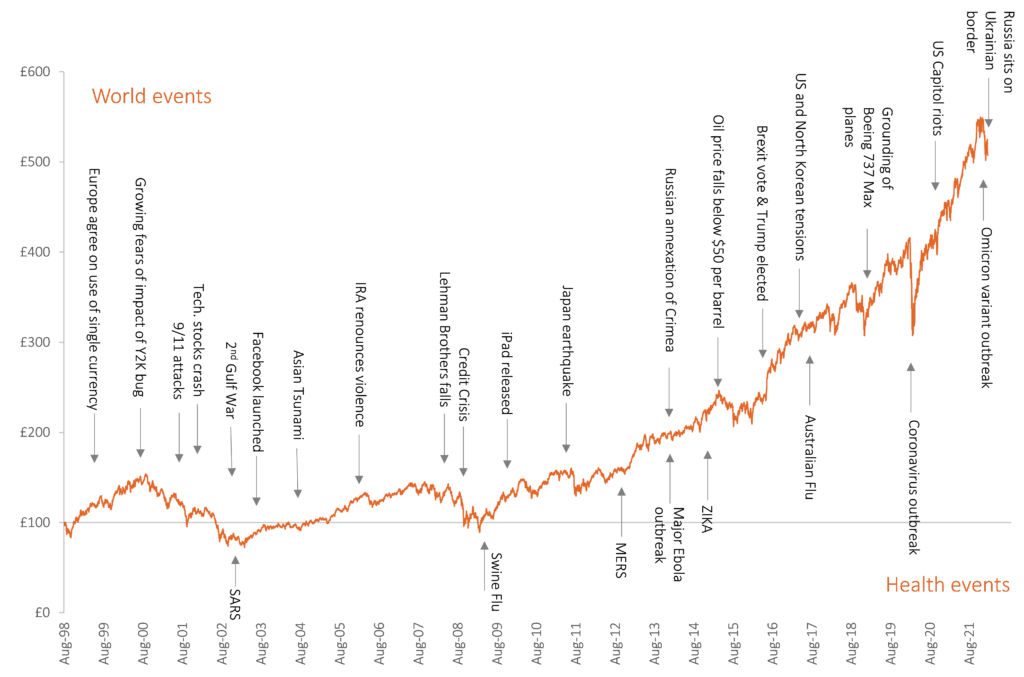

It’s always easy to feel that the present is more uncertain than the past. We have all but forgotten the Armageddon scenarios of events such as the Y2K software bug issues of 2000 (planes expected to fall out of the sky, nuclear power stations potentially out of control etc.), the emotional and geopolitical impact of 9/11, or the fear many felt in 2008 when Lehman Brothers failed and the meltdown of the financial system was a real risk.

The chart below illustrates that over the mid- to longer-term, the markets absorb the consequences of such events and power forwards as capitalism drives the relentless pursuit of profit opportunities.

Figure 1: Material global events are ever-present Data source: Vanguard Global Stock Index ACC, 4/8/1998 to 14/2/2022 in GBP used as proxy for the performance of global equities. Its use in this chart does not constitute any form of recommendation and is provided for educational purposes only.

Data source: Vanguard Global Stock Index ACC, 4/8/1998 to 14/2/2022 in GBP used as proxy for the performance of global equities. Its use in this chart does not constitute any form of recommendation and is provided for educational purposes only.

So being shaken out of markets based on the latest news is just about the worst mistake any long-term investor can make.

If you’re sensibly invested in a well-diversified portfolio that matches your risk appetite, don’t let the headlines shake your resolve. Slow and steady wins the race.

And if you’re not, it’s time to speak to a good financial planner. Book a call with Citywide to get started.

This was adapted from an article from one of our partners, Albion Strategic Consulting, with their permission.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Categories: Investments, Markets