A new year usually goes hand-in-hand with promises to set up good habits and give up the bad ones. But it’s an unfortunate truth that most New Year’s resolutions will fail, with around 80% abandoned by mid-February. There’ll be various reasons for this, but often it’s just about trying to take on too much, too soon. Feeling under pressure and overwhelmed is not the most sustainable (or enjoyable) path to self-improvement.

There is a better way, and it’s articulated brilliantly in James Clear’s bestseller, ‘Atomic Habits’. The idea is that through small improvements, day by day, tiny changes can bring remarkable, life-transforming results. We found it so inspiring that we’d like to unpack and share some of his key insights in a series of articles.

For this first one, we’ll give a general overview and focus on what Clear calls his first ‘law of behaviour change’ to build better habits.

Atomic habits in a nutshell

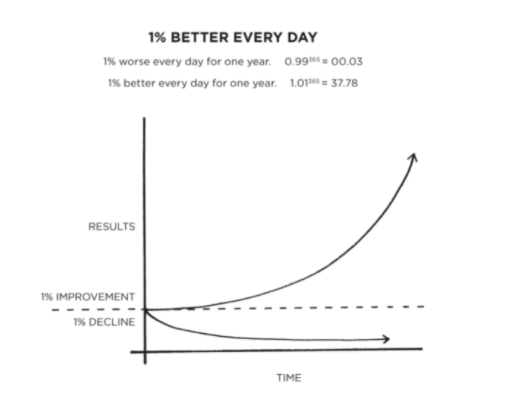

You’ll know that when investing, you can expect to see more growth through compound interest as time goes on. Habits, for James Clear, are the compound interest of self-improvement. Consistently drip-feed a small behavioural change, and over time you’ll accumulate real returns. You might not notice any change while you’re in the thick of it – and will probably experience a frustrating plateau – but after a year of getting 1% better at something every day, you’ll have improved 37%. Do the reverse, however, and you’ll have declined to pretty much zero.

Eventually, says Clear, “you get what you repeat”. Your outcomes are the ‘lagging indicators’ of your habits. For example, your net worth is a lagging indicator of your saving and spending habits, your physical fitness is a lagging indicator of your eating and training habits, and your knowledge is a lagging indicator of your learning habits.

The trick is not to get too hung up on goals and results – the how is more important than the why. Every team wants to win the championship, but it’s how they train and ultimately play that will make it happen or not – not their desire to win. Says Clear, “You do not rise to the level of your goals. You fall to the level of your systems.” If your goal is to save X amount over a certain time, for example, you’ll only get there if you build a system to save regularly and invest sensibly.

How do you go about incorporating those small but mighty habits into your daily life so that they stick and make a difference? Clear has a set of rules – four laws of behaviour change – to build better habits: 1. Make it obvious; 2. Make it attractive; 3. Make it easy; 4. Make it satisfying. Here, we’ll explore the first.

How to make it obvious

Change starts with awareness – you need to be conscious of the habits you want to nurture and discard before you can address them. As many existing habits are done on autopilot and seem insignificant, this may be harder than it seems. And because many habits aren’t inherently bad or good, it can be difficult to rank their value. Take having a shop-bought coffee every morning – this may help you focus and be the first step of a beneficial routine… or it may mean you buy an unnecessary box of pastries every day that affects both your long-term health and saving goals.

Often when people drop resolutions or pick up bad habits again, it’s due to a lack of clarity, not motivation. Here are some tools to get on the right track.

- Habits scorecard – When it comes to your money behaviour, try making a financial journal of your transactions. By assigning a plus sign (+) next to positive actions, a minus sign (-) next to detrimental spending, and an equals sign (=) for neutral transactions, you can track your money habits and identify what can be improved.

- Hone your identity – It can help to visualise who you want to be. If you want to sail well, think of yourself as an accomplished yachtsman – what learnings and steps would you have taken to become so good? Or if you want to retire early, work backwards to identify the characteristics and actions you’d need to get there. Then pick only the habits that reinforce that identity.

- Make a plan – Consistent efforts eventually become automatic and much easier with time, but to begin with, you need to carve out time and space for them. Having specific actions planned out in advance removes the decision-making process. Let’s say you want to get fitter – writing down a specific time in your diary and planning your route to the gym will make you much more likely to go. Or if you want to save more, creating an automated transfer to a savings account on payday means you don’t have to think about it (and removes the option to spend it first!)

- Habit stacking – Momentum is a powerful force you can use by adding the new habit onto an existing one. Think of it in these terms: “after [current habit], I will [new habit]”. In practice, this could look like: “after I pour my cup of morning coffee, I will meditate for two minutes”, or “after I receive my credit card statement, I will pay it all off in one go.”

Getting started

At Citywide, we absolutely agree that, just as with saving, a series of small actions can make a real difference to your returns in life. That’s why our financial planning process is about so much more than just numbers. We’re here to help you pinpoint your life goals and identify the habits that can unlock the financial freedom to get you where you want to be. Contact us on 01372 365950 to get started.

In our next blog in this series, we’ll look at Clear’s second law of behaviour for building better habits: Making it attractive.

Categories: Financial Planning, Wellbeing